Mastering Exness Day Trading: Strategies for Success

Day trading is a unique approach to trading that involves buying and selling financial instruments within the same trading day. Traders leverage price movements in a short timeframe to capitalize on small price changes. In this article, we will delve into the world of Exness day trading, exploring strategies and tips that can improve your trading outcomes. For those interested in further investment avenues, you can learn how to buy Amazon shares Exness day trading http://rtbsrypin.pl/index.php/exactly-how-to-buy-amazon-amzn-shares/.

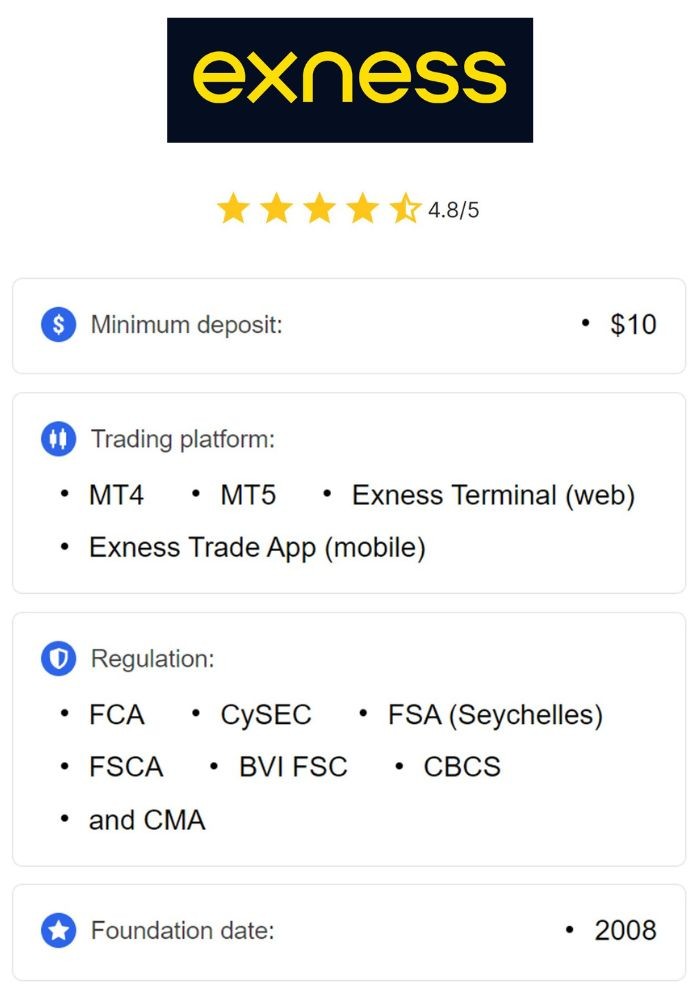

Understanding Exness as a Trading Platform

Exness is a well-regarded broker known for its favorable conditions for day trading. Founded in 2008, it has established itself globally, offering services to traders in various countries. Key features that make Exness an attractive option for day traders include:

- Low Spreads: Competitive spreads mean lower costs when entering and exiting trades.

- High Leverage: This allows traders to amplify their positions, which can lead to greater profits (or losses).

- Quick Execution: A fast-order execution rate is crucial for day trading, where every second can mean the difference between profit and loss.

- Diverse Asset Range: From forex pairs to cryptocurrencies and commodities, Exness offers a variety of trading instruments.

Developing a Trading Plan

A well-structured trading plan is essential for anyone considering Exness day trading. This plan should encompass your trading goals, risk tolerance, and analysis techniques. Here’s how to build a robust trading plan:

- Set Clear Goals: Define your financial goals, whether they are short-term gains or long-term wealth accumulation.

- Risk Management: Establish how much capital you are willing to risk on each trade. A common rule of thumb is to risk no more than 1% of your total trading capital per trade.

- Choose Your Markets: Focus on markets that you understand well. Familiarize yourself with their movements and volatility.

- Determine Your Strategy: Decide on the technical indicators and fundamental analysis methods you will use to make trading decisions.

Key Strategies for Successful Day Trading

Here are a few strategies that can be particularly effective for day trading on Exness:

1. Scalping

Scalping involves making multiple trades throughout the day to profit from small price fluctuations. Traders need to be quick and decisive, capitalizing on ultra-short-term movements. Scalping requires a lot of focus and a deep understanding of market dynamics.

2. Trend Following

This strategy is based on identifying a market trend and trading in the direction of that trend. Day traders often use technical indicators to help identify trends, such as the Moving Average or the Relative Strength Index (RSI). By entering trades that align with prevailing trends, traders can increase their chances of success.

3. Range Trading

Range trading focuses on identifying support and resistance levels. Traders buy when the price approaches the support level and sell when it nears the resistance level. This strategy works well in a sideways market and requires constant monitoring of price action.

Utilizing Technical Analysis

Technical analysis is a pivotal aspect of day trading. Traders analyze price charts and use indicators to forecast future price movements. Some common indicators include:

- Moving Averages: These help smooth out price action and identify trends over time.

- MACD: The Moving Average Convergence Divergence indicator helps identify potential buy and sell signals through momentum shifts.

- Bollinger Bands: These assist in determining overbought or oversold conditions, which can signal potential price reversals.

Psychology of Day Trading

The psychological aspect of trading can not be underestimated. Traders need to develop emotional discipline to deal with inevitable losses and maintain a level-headed approach. Here are some tips for managing trading psychology:

- Stick to Your Plan: Avoid deviating from your trading plan, even if emotions run high during significant price movements.

- Accept Losses: Learning to accept losses is crucial in maintaining an overall positive mindset toward trading.

- Take Breaks: If you find yourself making impulsive decisions, step away from the screen and take a break to regain your focus.

Conclusion

Exness day trading offers exciting opportunities for traders willing to put in the effort to develop their skills and strategies. By establishing a comprehensive trading plan, employing effective strategies, utilizing technical analysis, and managing your psychology, you can increase your chances of success. Remember, day trading is not merely a game of luck; it requires understanding, discipline, and a commitment to lifelong learning in the ever-evolving financial markets.